when will capital gains tax rate increase

The capital gains tax rate increase to an effective rate of 434 the proposed 396 rate plus 38 net investment income tax would put a lot more pressure on recognition. Discover Helpful Information And Resources On Taxes From AARP.

Potential Changes To The Capital Gains Tax Rate Publications Foley Lardner Llp

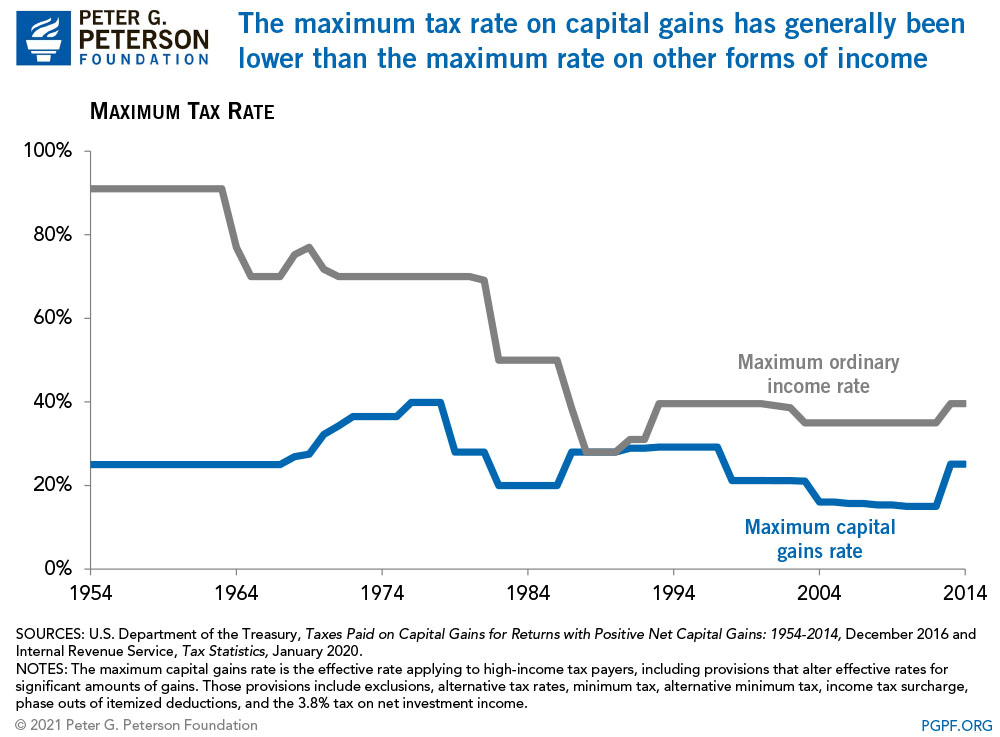

From 1954 to 1967 the maximum capital gains tax rate was 25.

. President Joe Biden proposed a top federal tax rate of 396 on long-term capital gains and qualified dividends. A taxpayer has a 1 million long-term capital gain on December 31 2021 and invests it into an Opportunity Zone Fund. Youll owe either 0 15 or 20 on gains from the sale of most assets or investments held for more than one year depending on your annual taxable income for more.

Choose Avalara sales tax rate tables by state or look up individual rates by address. If you sell stocks mutual funds or other capital assets that you held for at least one year any gain from the sale is taxed at either a 0 15 or 20 long-term capital gains tax rate. Most single people with investments will fall into the.

Add this to your taxable. In 2022 individual filers wont pay any capital gains tax if their total taxable income is 41675 or less. 100000 of the capital gains would be taxed at the current long-term capital.

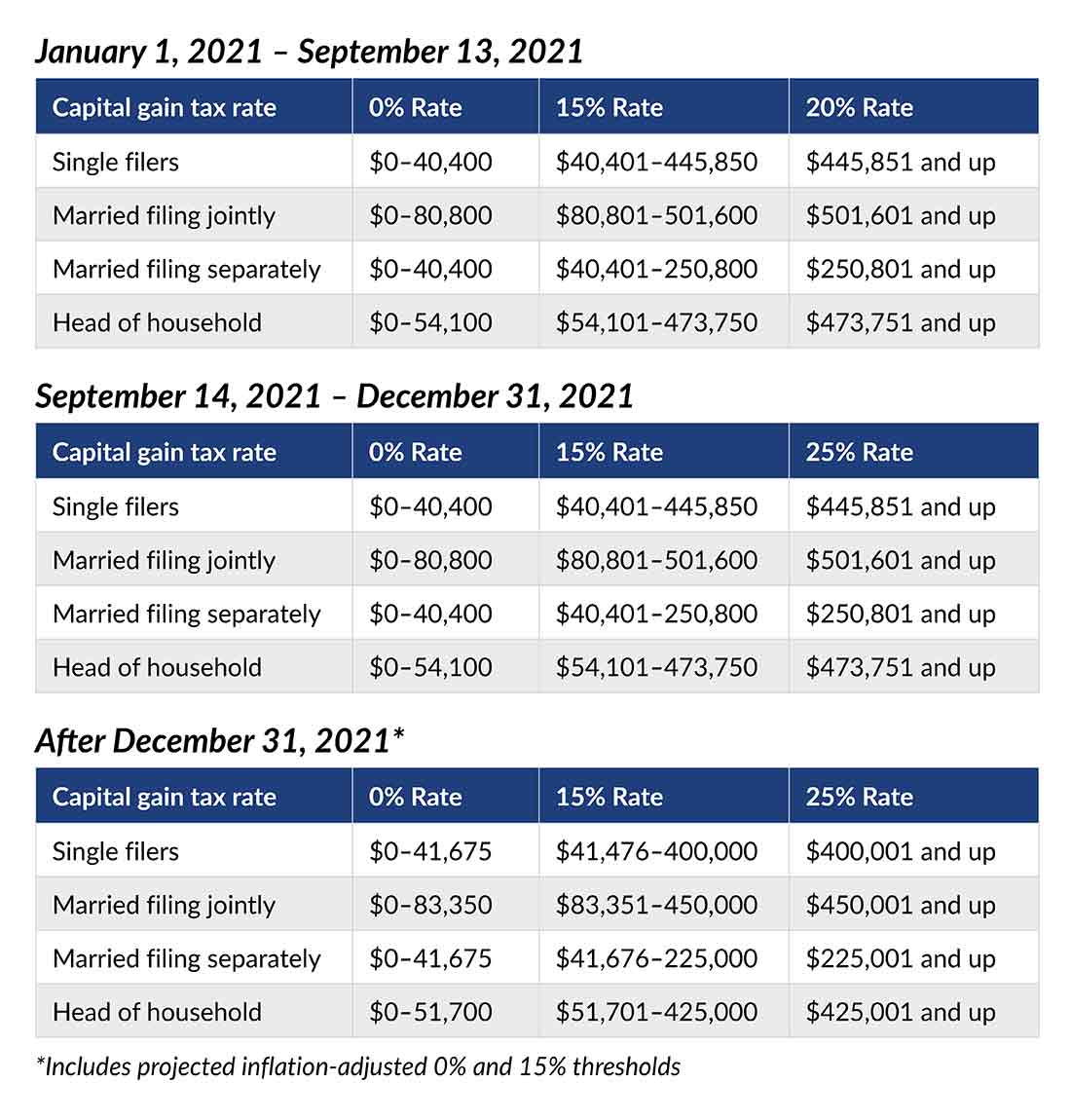

The proposal would increase the maximum stated capital gain rate from 20 to 25. The top rate would be 288 when combined with a 38 surtax on net investment income. We Can Help Reduce the Rate Increase Impact.

Capital gains tax rates were significantly increased in the 1969 and 1976 Tax Reform Acts. The plan also proposes changes to long-term capital gains tax rates nearly doubling the tax rate for high-income individuals by increasing it from 20 to 396. First deduct the Capital Gains tax-free allowance from your taxable gain.

Your 2021 Tax Bracket To See Whats Been Adjusted. The effective date for this increase would be September 13 2021. The rate jumps to 15 percent on capital gains if their income is 41676 to.

The gains that you make from the selling of your capital assets which you held for at least one year will be considered long-term gains and these can be taxed at anything from 0. Ad Go See Estimated Capital Gain Distributions And Explore Tax-Efficient iShares ETFs. 2023 capital gains tax rates The capital gains tax rate is 0 15 or 20 on most assets held for longer than a year.

Get Smart with a Free Rate Increase Guide. Ad Compare Your 2022 Tax Bracket vs. Help Clients Keep More of What They Earn During Tax Season.

Or sold a home this past year you might be wondering how to avoid tax on capital gains. There are proposals to increase the top tax rate on investment gains to. For single tax filers you can benefit from the zero percent capital gains rate if you have an income below 41675 in 2022.

The proposed increase would tax long-term gains over 1 million as ordinary income which means that these high-income investors would have to pay a top rate of 396. Ad Download Avalara rate tables each month or find rates with the sales tax rate calculator. For example a single person with a total short-term capital gain.

Higher taxes on long-term capital gains now occupy a prime position on the agenda in Washington. Ad If youre one of the millions of Americans who invested in stocks. Common Surcharges Rate Increases 10 Year UPS Pricing Trends More.

In 2022 it would kick in for. Capital gains taxes on assets held for a year or less. Tax Changes and Key Amounts for the 2022 Tax Year.

2022 federal capital gains tax rates Just like income tax youll pay a tiered tax rate on your capital gains. President Biden wants to increase the long-term capital gains tax for wealthier Americans. With average state taxes and a 38 federal surtax the.

The new rate would apply to gains realized after Sep. The table below breaks down long-term capital gains tax rates and income brackets for tax year 2022. For the 2021 to 2022 tax year the allowance is 12300 which leaves 300 to pay tax on.

In 1978 Congress eliminated. Assume the Federal capital gains tax rate in 2026 becomes 28.

How The Biden Capital Gains Tax Proposal Would Hit The Wealthy

.png)

Biden S Green Book Includes Retroactive Capital Gains Tax Increase Husch Blackwell Llp Jdsupra

What You Need To Know About Capital Gains Tax

How Does The Capital Gains Tax Work Now And What Are Some Proposed Reforms

Democrats Propose Higher 25 Capital Gains Tax Rate Here Are 3 Ways To Minimize The Potential Hit Bankrate

How The Biden Tax Plan Will Impact The Economy

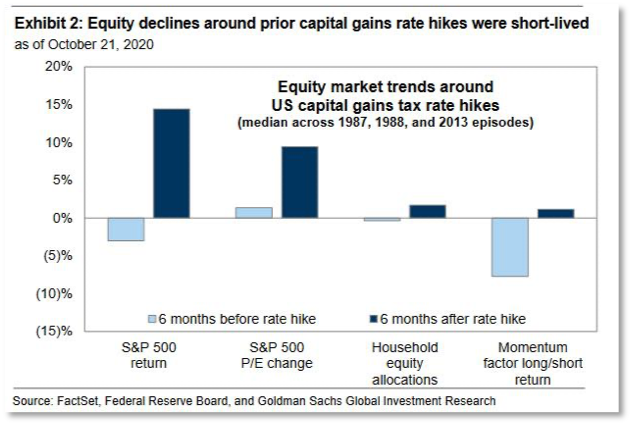

Capital Gains Tax Rates And Economic Growth Or Not

Do Capital Gains Tax Increases Reduce Revenue Committee For Economic Development Of The Conference Board

Capital Gains Tax Rates For 2022 Vs 2021 Kiplinger

When And How Much The Tax Rate On Capital Gains Will Rise Could Become Clear On May 27 When Biden Releases His Budget Financial Planning

Capital Gains Are Sensitive To Taxation Jct Report Tax Foundation

2021 2022 Long Term Capital Gains Tax Rates Bankrate

What Is The Effect Of A Lower Tax Rate For Capital Gains Tax Policy Center

Paying The Piper The Impact Of An Increased Capital Gains Tax Rate When Selling Their Business Rocky Mountain Business Advisors

Private Equity Faces Increase In Capital Gains Tax Rate Our Insights Plante Moran

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

Capital Gains Tax Proposal Spurs Car Dealers To Merge Automotive News